I've kept all my cash in a savings account since the stock market crash. That's the modern day equivalent of putting it under the mattress. I'm getting well under 1%, but I haven't had the stomach to invest in this destructive economy either. Nor patronize the major banks that caused the collapse. I've been looking for something else.

My search intensified when I learned that my bank, Wells Fargo, bilked around $2 billion from their customers in unnecessary overdraft charges. That really hit home. While I didn't lose any money, the thought of a big bank stealing babysitting money and college savings from families got my hairs up. Arianna Huffington's Move Your Money Campaign started to make a lot of sense. And the friendliness of the tellers at my local Wells Fargo branch started to seem a tad contrived.

So, two weeks ago, with the help of Rob Garcia (thanks Rob!) of LendingClub, I took the plunge into social lending. The difference between traditional lending and social lending is that instead of banks making loans to individuals, individuals make loans to other individuals. I became a lender to strangers who are mostly using Lending Club to consolidate credit card debt. Hmm, sounds a little like a peer to peer bailout…

Bailouts aside, the advantage of social lending is compelling. Borrowers get much lower rates than banks can offer. And lenders get much better returns than what a savings account offers. So, instead of my puny sub-1% annual return, I'll likely get just over 9%, the average for lenders on LendingClub. This is comparable to long-term stock market returns (around 12%), though with less volatility. And banks are simply left out of the equation. I like that.

Now the idea of loaning money to strangers might sound scary. However, given the safeguards, I find it as reasonable as buying stocks, if not more. For instance, all borrowers are screened and their loans priced by the system according to their credit scores. The better the credit score of a borrower, the lower the rate. You can limit your investing to top rated borrowers if you want to play it safe. This will still get you 5-6%, about ten times what I'm getting from my savings account. Also, the system encourages you to make small loans to many individuals. LendingClub's 9% platform average factors in defaults, which run 2-3%.

Making small loans to many people is made surprisingly easy by the platform. You can invest in portfolios of loans the system puts together for you based on your financial goals and risk tolerance. Once money is deposited, you can loan out thousands of dollars in a few minutes this way. Or, if you want to nerd out and try to beat the platform average, you can download loan data, crunch numbers, and create your own portfolio by selecting loans individually. Check here for a clever strategy FrugalDad developed for LendingClub.

Here's more on how LendingClub works, which I assume is similar to other platforms. Other social lending platforms include Prosper, Virgin Money, Zopa (UK), CommunityLend, Kiva, and Fynanz (students). Am I missing any? Feel free to list more in comments.

That's all I want to say about it for now. Social lending seems like a smart move, but I consider this an experiment. I'm only putting a small percentage of my savings in LendingClub. I'd like to see how it goes before investing more.

Here's a few basic tips inspired by Rob Garcia if you'd like to give it a try:

- Invest small amounts in many loans

- Invest $2,500 to $5,000 to start if possible. This protects you from the 2-3% default rate. One default can ruin returns on a small investment.

- Expect defaults. Remember that it's the overall return that matters.

- You don't need get hung up in evaluating every loan. Loaning small amounts to many people offers the best protection.

- Treat this like any investment. Loan or portfolio selection should depend on your needs, goals, life stage, and risk tolerance.

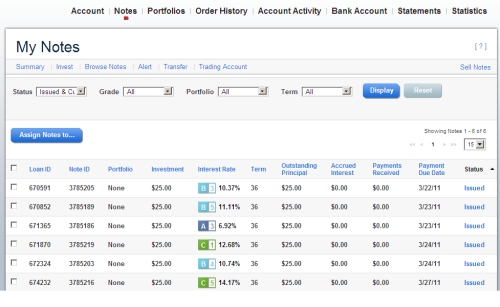

Detail of one of the dozens of loans I made in just a few minutes after I understood the system.